How does GST help in equal taxation? What is GSTR, GSTIN and GSTN?

Before GST came into effect, the central government charged excise duty on the purchase and sale of goods and services. The state in which the goods are manufactured collects the tax. So the tax rates are different for every state. This led to a huge problem for multinational corporations to start operations in India. Along with that this also leads to an unbalanced economy among the states. For example, most of the factories and production houses have set up their plant in Gujarat. This is because the tax ratio is the lowest there.

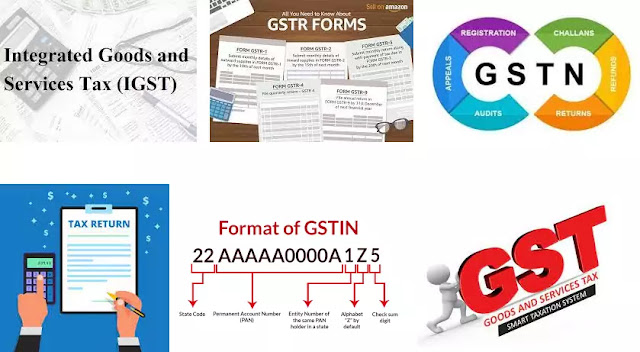

With the implementation of the GST bill, any commodity that is manufactured and sold in any other state, Integrated GST also known as destination GST will be charged. Where the central keep its amount and transfers the rest to the state where the goods are sold. This also results in the same tax all over the country.

GSTR stands for GST Return, GST is such a type of multilayer tax that remains with the seller after the product is sold. For example: suppose the product costs 100 INR with 10% GST the cost price becomes 110 INR, therefore the selling price is set at 150 INR, with the same GST, GST becomes 15 INR. The amount of GST to be paid is 10+5 = 15. To pay this amount, GSTR billings are done thrice a month. Billings are of different types like GSTR 1, GSTR 2, GSTR 2A, GSTR 3B, GSTR 4, and GSTR 9.

GSTIN stands for the GST Identification Number and is of 15 digits.

Format: 99 QQQQQ4444Q E77, the first two being the state code the ten characters after that is the PAN no and the last three are the unique code generated by the computer.

GSTN stands for GST Network. This network helps in the application process, filling of the return, accounting of fund transfer between the central and the state, matching of tax payment details with authorized banks, etc.