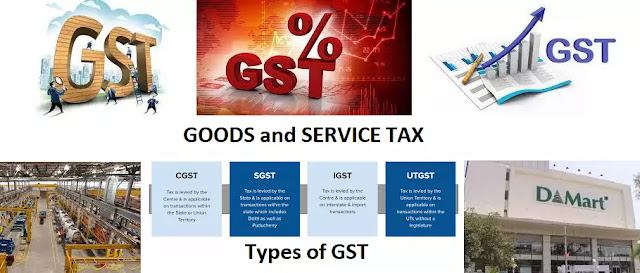

What is GST? Who is entitled to pay GST? Types of GST

Goods and service Tax often abbreviated as GST is a new form of indirect tax that is comprehensive and multistage introduced on 1st of July 2017.

Generally, a person pays direct taxes, which include, income tax, corporation tax, property tax, etc. GST has nothing to do with these. But it has merged all the 17 types of indirect taxes such as custom duties, excise tax, service tax, etc. These indirect taxes are charged on the sale and purchase of goods or services.

Three persons are entitled to pay the GST.

- A person who owns a type of business with an annual turnover of 20 lakhs INR regardless of the amount of profit. In hilly regions, this criteria is somewhat different and the limit of turnover is set at 10 lakhs INR a year.

- A person who does the business that involves two or more states or union territories.

- E-commerce businesses like Zomato, Flipkart, are entitled.

GST is of four types:

- CGST: Central GST or CGST is the amount of the GST that is collected by the government of the country.

- SGST: State GST or SGST is the amount of the tax that is retained by the government of the state.

- UTGST: Union Territory GST or UTGST is collected by the union territory as the product is manufactured and sold in a union territory.

- IGST: Integrated GST or IGST is a type of GST charged when the product is manufactured and sold in some other state/ UT.

The person who is paying off the GST pays for any two. For example:

- Manufactured and sold in same state: CGST + SGST is applicable. If GST charged is 18% then CGST stands 9% and SGST 9%. This is similar in the case of union territories also, in place of SGST, UTGST is charged.

- Interstate/ UT: only IGST is charged and the rate stands as 18% IGST. The state or the UT where the goods get sold gets 50% of the IGST charged.

Tags:

Economics